For the first time, India’s stock market has surpassed Hong Kong’s, marking another achievement for the South Asian nation. India’s attractive growth prospects and policy reforms have positioned it as a favored destination for investors. The combined value of shares listed on Indian exchanges reached $4.33 trillion as of Monday’s close, versus $4.29 trillion for Hong Kong, according to data compiled by Bloomberg. That makes India the fourth-biggest equity market globally. Its stock market capitalization crossed $4 trillion for the first time on Dec. 5, with about half of that coming in the past four years.

India’s Thriving Equities:

Equities in India have been booming, thanks to a rapidly growing retail investor base and strong corporate earnings. The world’s most populous country has positioned itself as an alternative to China, attracting fresh capital from global investors and companies alike, thanks to its stable political setup and a consumption-driven economy that remains among the fastest-growing of major nations.

“India has all the right ingredients in place to set the growth momentum further,” said Ashish Gupta, chief investment officer at Axis Mutual Fund in Mumbai.

Indian Stock Rally Surges Amidst Historic Slump in Hong Kong

The relentless rally in Indian stocks has coincided with a historic slump in Hong Kong, where some of China’s most influential and innovative firms are listed. Beijing’s stringent anti-Covid-19 curbs, regulatory crackdowns on corporations, a property-sector crisis and geopolitical tensions with the West have all combined to erode China’s appeal as the world’s growth engine.

They have also triggered an equities rout that’s now reaching epic proportions, with the total market value of Chinese and Hong Kong stocks having tumbled by more than $6 trillion since their peaks in 2021. New listings have dried up in Hong Kong, with the Asian financial hub losing its status as one of the world’s busiest venues for initial public offerings.

However, some strategists expect a turnaround. UBS Group AG sees Chinese stocks outperforming Indian peers in 2024 as battered valuations in the former suggest significant upside potential once sentiment turns, while the latter is at “fairly extreme levels,” according to a November report. Bernstein expects the Chinese market to recover, and recommends taking profits on Indian stocks, which it sees as expensive, according to a note earlier this month.

More Stories

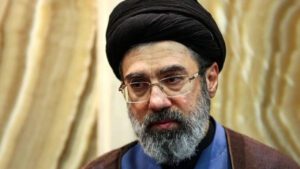

कौन हैं मोजतबा ख़ामेनेई, जिन्हें अगल सुप्रीम लीडर माना जा रहा है

RSP Leads Nepal Election 2026

AIIMS जोधपुर से पढ़ाई, UPSC में टॉप कर बने मिसाल अनुज अग्निहोत्री