The Reserve Bank of India (RBI) maintained its benchmark interest rate at 6.5% during the year’s final Monetary Policy Committee (MPC) meeting, citing persistent inflation risks. This decision comes despite a slowdown in economic growth, with the central bank prioritizing price stability. The repo rate had previously been raised by 250 basis points between May 2022 and February 2023.

Also read: Delhi Metro Blue Line Disrupted Between Moti Nagar and Kirti Nagar Due to Theft

Government Pushes for Rate Cuts to Stimulate Growth

Top government officials, including Union Commerce Minister Piyush Goyal and Finance Minister Nirmala Sitharaman, urged the RBI to lower interest rates to support growth. Goyal criticized the inclusion of food inflation in rate decisions, while Sitharaman emphasized the need for affordable bank rates to boost industrial capacity-building. However, the RBI defended its stance, warning that rate cuts could destabilize inflation control efforts.

Also read: Sukhbir Badal Performs ‘Sewa’ at Takht Kesgarh Sahib After Attack

Inflation Remains a Major Concern for RBI

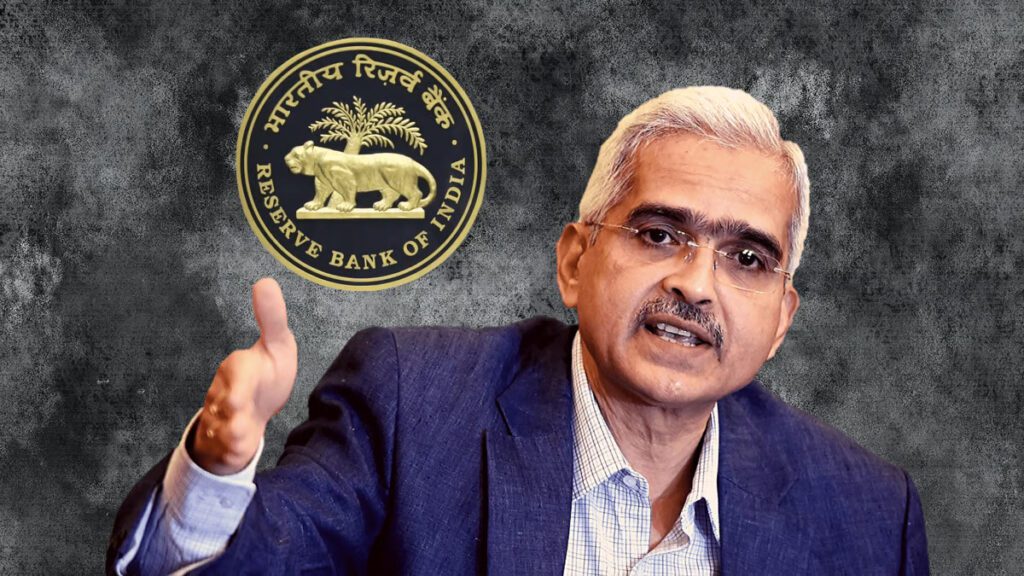

Retail inflation in India hit a 14-month high of 6.21% in October, far exceeding the RBI’s 4% target. RBI Governor Shaktikanta Das highlighted the importance of durable price stability for sustainable growth during a live address. The MPC unanimously retained a “neutral” policy stance to balance inflation management with growth support.

Also read: Maharashtra CM Oath: Shinde, Pawar as Deputies.

Growth Target Lowered as GDP Slows

The RBI revised its growth forecast for the fiscal year to 6.6%, down from 7.3%, following GDP growth hitting a seven-quarter low in the July-September period of FY25. Calls for reducing the repo rate have intensified as slowing growth pressures businesses. The repo and reverse repo rates remain critical tools for regulating borrowing costs and managing economic growth, underscoring the delicate balance between inflation control and growth stimulus.

Also read: Shah Rukh Khan : hesitance to take on a supporting role

More Stories

नेपाल में बालेन शाह की पार्टी RSP ने दर्ज की बड़ी जीत अन्य पार्टियां काफी पीछे

IND vs NZ T20 World Cup Final: What Kind of Pitch Will Ahmedabad Offer

AIIMS जोधपुर से पढ़ाई, UPSC में टॉप कर बने मिसाल अनुज अग्निहोत्री