The long-simmering hostilities between Israel-Iran have clouded international markets, raising fears among investors about the possibility of a full-fledged war and its impact on the world economy. Amid growing tensions between the two nations and an unpredictable landscape, investors are still apprehensive.

Analysts foresee increased volatility amid geopolitical uncertainty, warning of potential panic selling across asset classes.

Iran Strikes Israel After Airstrike; Tension Escalates, Generals Slain

On April 13, Iran launched a direct military attack on Israel in retaliation for an Israeli airstrike that targeted its consular compound in Syria, sparking heightened tensions throughout the Middle East. The conflict claimed the lives of two well-known Iranian generals. Hossein Amirabdollahian, the foreign minister of Iran, stated that before the attack, Iran had given a 72-hour warning to neighbouring nations and the United States, an important friend of Israel.

Also READ: ऑस्ट्रेलिया: सिडनी में फिर चाकूबाजी की घटना, चर्च में पादरी और कई लोगों पर हुआ हमला

India Vulnerable to Oil Price Spikes Amid Iran-Israel Conflict

India is highly dependent on imports of Iranian crude oil, which leaves it open to changes in world prices. The prolonged hostilities between Israel and Iran pose a threat to Middle Eastern energy supplies and could drive up the cost of crude oil.

WealthMills Securities’ Director of Equity Strategy, Kranthi Bathini, emphasized the impending impact the Iran-Israel conflict will have on crude oil prices. This can exacerbate the uncertainty around rate reductions and negatively impact investor mood. As a result, worries about supply interruptions caused oil prices to soar, and demand for safe-haven assets like gold and the dollar rose.

Also READ: Israel Iran Tension: ‘कीमत तो चुकानी होगी’, इस्राइल ने ईरान को दी चेतावनी

Iran-Israel Conflict Adds to Stock Market Pressure Amid Rate Cut Uncertainty

The US inflation data for March has added to the downward pressure already facing the stock market, which has been worsened by dwindling hopes for a large interest rate drop from the US Federal Reserve this year. The crisis between Iran and Israel may cause oil prices to rise above $100 per barrel, according to reports that have further soured investor sentiment.

Also READ: IndiGo Flight Incident Raises Safety Concerns

New Middle East Conflict Threatens Global Supply Chains, Indian Rupee

The ongoing conflict between these two Middle Eastern nations has the potential to seriously disrupt global supply networks and upset the delicate balance between imports and exports. The Indian rupee’s stability is threatened by these disruptions, which might push it lower and even to all-time lows. Due to the general lack of optimism, the rupee began Monday’s trading session poorly, falling 6 paise to hit 83.44 against the US dollar.

More Stories

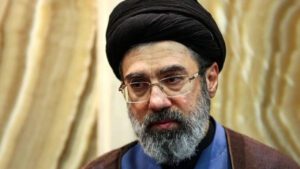

कौन हैं मोजतबा ख़ामेनेई, जिन्हें अगल सुप्रीम लीडर माना जा रहा है

RSP Leads Nepal Election 2026

AIIMS जोधपुर से पढ़ाई, UPSC में टॉप कर बने मिसाल अनुज अग्निहोत्री