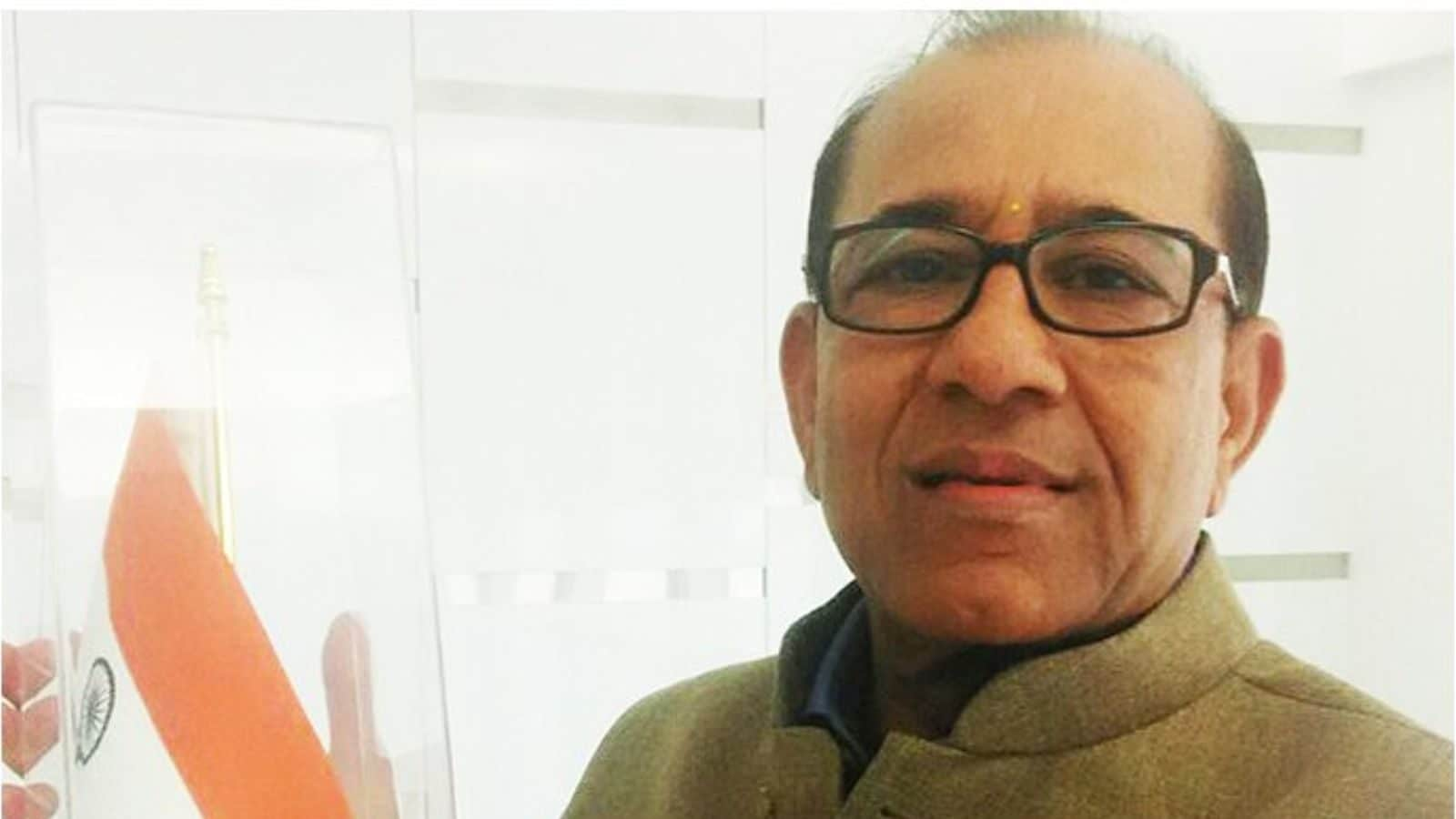

Vinod Adani, Gautam Adani’s brother, resigned as a director of three firms involved with the family’s coal mines in Australia: Carmichael Rail and Port Singapore, Carmichael Rail Singapore, and Abbot Point Terminal Expansion.

As reported by Bloomberg News, this decision was made in late February, despite mounting pressure on the Adani Group.

Vinod Adani, on the other hand, remains a member of the board of Abbot Point Port Holdings, which is domiciled in Singapore.

The report states that this resignation occurred a few days before the Supreme Court appointed a committee to investigate whether the regulators had failed in overseeing the Adani Group. Meanwhile, Sebi is scrutinizing whether some transactions between Vinod Adani and the group were adequately disclosed.

According to a representative from the Adani Group quoted in the Bloomberg report, Vinod had no involvement in managing the development of the Carmichael mine or its related infrastructure, despite being a shareholder in certain entities.

However, Hindenburg’s report on January 24th alleged that numerous shell companies controlled by Vinod had transferred billions of dollars in and out of Adani Group companies in an effort to inflate shares and results.

While the Adani Group acknowledged Vinod’s status as part of the promoter group and stated that all necessary disclosures were made, it declined to comment on his business dealings as they are deemed irrelevant given his lack of management role in the group’s public companies or their subsidiaries.

According to a report by Bloomberg, Gautam Adani keeps a cabin in the Adani Global headquarters in Dubai, a commodity distributor that is a subsidiary of one of the publicly traded companies in his family. He reportedly spends two to three hours there every day.

When questioned about this, an Adani Group representative dismissed the inquiry as irrelevant. Gautam’s older brother, who is 74 years old and relatively unknown until recently, is believed to have accumulated a fortune trading commodities, estimated to be worth at least $1.2 billion.

He manages a family investment office based in Dubai and has been involved in significant ventures of the Adani Group, including the acquisition of cement companies and green energy projects like the Carmichael undertaking, which has been a long-standing example of their collaboration.

More Stories

Two Lok Sabha MPs Refuse Salary: Meet the Lawmakers Who Decline Pay

IT कंपनियों पर बढ़ सकते हैं साइबर हमले NASSCOM ने सुरक्षा बढ़ाने की दी सलाह

US-Iran conflict impact: Market turmoil and protests in Parliament